Gold has been receiving an increasing amount of attention recently as the metal soars to new record levels. But you don’t have to trade gold to benefit from the metal’s recent volatility. In fact, many of the popular currency pairs have been moving in tandem with gold, offering forex traders an opportunity to piggyback on the uptrend or bet against it, with the added benefit of trading within the world’s deepest and most liquid market.

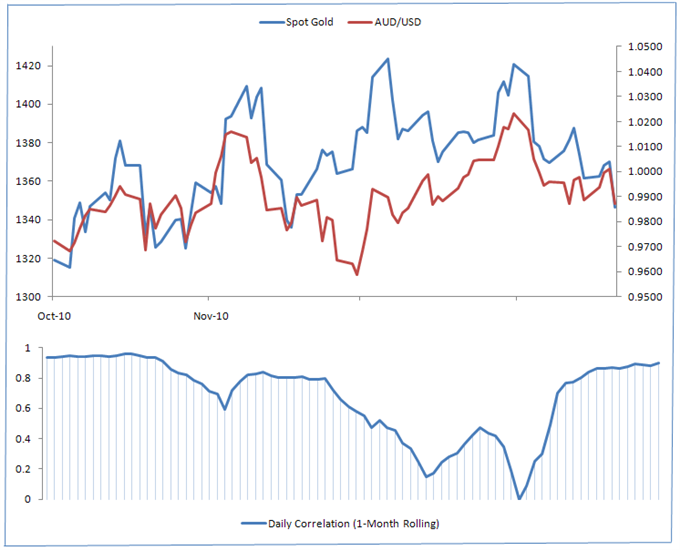

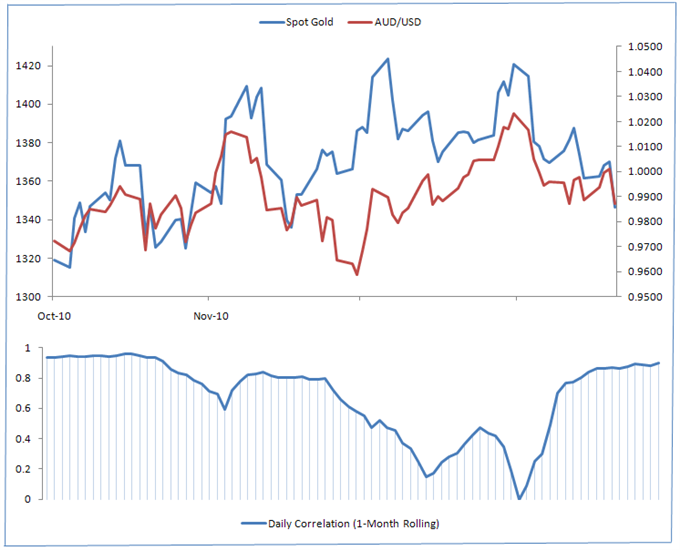

The following table includes the correlation between gold and the most popular currency pairs over various timeframes. A value close to +1 indicates a strong positive relationship between gold and the pair, while a value close to -1 indicates a strong negative relationship.

---------------------------------------------------------------------------------------------------------------------------------

Gold

USD/CAD

AUD/USD

NZD/USD

EUR/USD

GBP/USD

USD/JPY

USD/CHF

15 Min, 3 Day

-0.50

0.92

0.86

0.03

0.80

-0.75

-0.57

60 Min, 1 Week

-0.31

0.76

0.69

0.10

0.32

-0.60

-0.46

60 Min, 2 Weeks

-0.45

0.12

-0.08

-0.43

-0.31

0.17

0.40

Daily, 1 Month

0.32

0.91

0.42

-0.14

-0.66

-0.73

-0.80

Weekly Commentary: Gold – FOREX correlations fared better than last week, as rising interest rate expectations for some of the major central banks spurred selling in gold and high-yielding currencies. The correlation between gold and AUD/USD firmed to a solid 0.76 from close to zero last week, but that between gold and USD/CHF was close to unchanged at -0.46.

The divergence between the Aussie and Franc- the two currencies that have historically had the strongest relationship with gold- can likely be attributed to the fact that the Aussie is a high-yielding currency, while the Franc is a low-yielding currency. A recent increase in interest rate expectations for the ECB and BOE, for example, have reduced the relative appeal of the Aussie as much of said appeal comes from its yield. The Franc, on the other hand, has been supported by a general perception of safety rather than any yield considerations. Nevertheless, the Aussie and Franc should continue to move in the same direction over longer periods and thus we continue to recommend both for proxy gold exposure in the forex markets.

As for gold specifically, we saw a significant breakdown this week, with the metal finally breaking through support near $1360 after several attempts. As mentioned previously, interest rate expectations have been rising for many of the major central banks, spurred by hawkish commentary from certain policymakers and an uptick in inflation. Market expectations, as implied by overnight index swaps, suggest that the European Central Bank may raise rates three times over the next twelve months (75bps total). Expectations for the Bank of England are only slightly lower.

Meanwhile, gold ETF holdings have tumbled almost 1.6 million troy ounces since their recent peak, an indication of that investors are selling the metal. As investment demand has been the single most important driver of gold prices on the margin, the impact is significant. We can’t be sure whether the aforementioned increase in interest rate expectations is what is spurring this selling, but it is likely one of the many factors impacting trading.

---------------------------------------------------------------------------------------------------------------------------------

Gold prices fell as gold ETF holdings declined for a fifth straight week. Overall, gold ETF holdings are now down 1.6 million troy ounces from their peak near 68 million set back in December.

DailyFX provides forex news on the economic reports and political events that influence the currency market.

Gold has been receiving an increasing amount of attention recently as the metal soars to new record levels. But you don’t have to trade gold to benefit from the metal’s recent volatility. In fact, many of the popular currency pairs have been moving in tandem with gold, offering forex traders an opportunity to piggyback on the uptrend or bet against it, with the added benefit of trading within the world’s deepest and most liquid market.

The following table includes the correlation between gold and the most popular currency pairs over various timeframes. A value close to +1 indicates a strong positive relationship between gold and the pair, while a value close to -1 indicates a strong negative relationship.

---------------------------------------------------------------------------------------------------------------------------------

Gold | USD/CAD | AUD/USD | NZD/USD | EUR/USD | GBP/USD | USD/JPY | USD/CHF |

15 Min, 3 Day | -0.50 | 0.92 | 0.86 | 0.03 | 0.80 | -0.75 | -0.57 |

60 Min, 1 Week | -0.31 | 0.76 | 0.69 | 0.10 | 0.32 | -0.60 | -0.46 |

60 Min, 2 Weeks | -0.45 | 0.12 | -0.08 | -0.43 | -0.31 | 0.17 | 0.40 |

Daily, 1 Month | 0.32 | 0.91 | 0.42 | -0.14 | -0.66 | -0.73 | -0.80 |

Weekly Commentary: Gold – FOREX correlations fared better than last week, as rising interest rate expectations for some of the major central banks spurred selling in gold and high-yielding currencies. The correlation between gold and AUD/USD firmed to a solid 0.76 from close to zero last week, but that between gold and USD/CHF was close to unchanged at -0.46.

The divergence between the Aussie and Franc- the two currencies that have historically had the strongest relationship with gold- can likely be attributed to the fact that the Aussie is a high-yielding currency, while the Franc is a low-yielding currency. A recent increase in interest rate expectations for the ECB and BOE, for example, have reduced the relative appeal of the Aussie as much of said appeal comes from its yield. The Franc, on the other hand, has been supported by a general perception of safety rather than any yield considerations. Nevertheless, the Aussie and Franc should continue to move in the same direction over longer periods and thus we continue to recommend both for proxy gold exposure in the forex markets.

As for gold specifically, we saw a significant breakdown this week, with the metal finally breaking through support near $1360 after several attempts. As mentioned previously, interest rate expectations have been rising for many of the major central banks, spurred by hawkish commentary from certain policymakers and an uptick in inflation. Market expectations, as implied by overnight index swaps, suggest that the European Central Bank may raise rates three times over the next twelve months (75bps total). Expectations for the Bank of England are only slightly lower.

Meanwhile, gold ETF holdings have tumbled almost 1.6 million troy ounces since their recent peak, an indication of that investors are selling the metal. As investment demand has been the single most important driver of gold prices on the margin, the impact is significant. We can’t be sure whether the aforementioned increase in interest rate expectations is what is spurring this selling, but it is likely one of the many factors impacting trading.

---------------------------------------------------------------------------------------------------------------------------------

Gold prices fell as gold ETF holdings declined for a fifth straight week. Overall, gold ETF holdings are now down 1.6 million troy ounces from their peak near 68 million set back in December.

0 التعليقات:

Post a Comment